Starbucks

has been leading in restaurant industry in sales growth and unit growth for

over 20 years with little competition or challenge. All the while Starbucks continues to expand it retail partnerships around

the world selling ‘’kyan coffee” (canned) and selling lots of it elevating the Starbucks brands

relevance with consumers according to Steven Johnson Grocerant Guru® at Tacoma,

WA based Foodservice Soltuions®.

Starbucks

partnership have been and continue to be the right fuel to drive new electricity into Starbucks top line sales and bottom line profits

according to Johnson. In the minds-eye

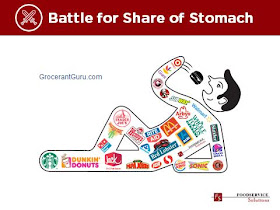

of Johnson, there is one dominate element that will power success within retail

and foodservice over the coming years and that is partnerships.

Johnson calls it the new

electricity that is partnerships specifically strategic

partnerships. The new electricity must be very efficient

for the supply and includes such things as fresh food, grocerant consultants, urban farming (produce, seafood, etc.), autonomous delivery, cashier-less

retail, cash-less payments, digital hand held marketing.

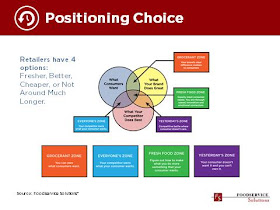

Retailers

the ilk of Starbucks in order to survive the next generation of retail must

embrace the artificial intelligence revolution while simultaneously embracing fresh food that is portable in some

form. That will require brands to embrace new fresh food partnerships

more now than ever before according to Johnson.

Starbuck’s

investments with cold CPG beverage products have now driven it in store focus

to revolve around cold beverage offerings as they continue to expand its lunch

menu edifying a grocerant niche mix and match meal bundling opportunity that is

second to none in the industry according to Johnson.

Rosalind

Gates Brewer, chief operating officer and group president of Americas, stated Starbucks

plans to continue investing in cold beverage innovation and expanding its

afternoon menu offerings.… Cold isn’t just for summertime anymore,”

Brewer

continued “Five years ago, cold was about 37% of our beverage mix, and now it’s

over 50%. With 2017, total cold beverage sales in the U.S. company and operated

stores reaching nearly $5 billion. So, we’re building multibillion-dollar

platforms within cold.”

Ms.

Brewer called Starbucks the “market leader” in the cold brew coffee category

and announced the company will be expanding the availability of its Nitro Cold

Brew platform from 2,300 stores around the world to 4,000 by the end of the

year.

Grocerant

niche mix and match bundling drives sales.

Brewer Stated “…the biggest opportunity for food innovation is for

lunch,” …we will offer customers more of what they are expecting and elevating

our current Bistro Box line, which has grown at a rate of 20% in each of the

past two years. We will also continue to roll out Mercato regionally, with more

than 1,000 stores by the end of the year.”

All good

retailers understand that selling hot food hot and cold food cold is job

one. Success does leave clues and

remembering that evolving food retail includes both hot and cold foods. Are you evolving your retail food platform to

include fresh? Or are you evolving your restaurant platform to include branded

CPG products?

Foodservice Solutions®

specializes in outsourced business development. We can help you identify,

quantify and qualify additional food retail segment opportunities or a new menu

product segment and brand and menu integration strategy. Foodservice Solutions® of

Tacoma WA is the global leader in the Grocerant niche visit

Facebook.com/Steven Johnson, Linkedin.com/in/grocerant/ or twitter.com/grocerant