Service

sells, but price competitiveness garners customer migration, repeat orders, and

long-term success according to Foodservice Solutions® Grocerant

Guru®.

Amazon is expanding Amazon Prime Now into the UK and all indications are

success will continue to flourish for Amazon.

Recently Keith Anderson, vice president of strategy

& insights at e-commerce analysts, Profitero, conducted a study to find out how Amazon would stack up in price

compared to existing UK retailers.

The

service is only available to members of Amazon Prime, which costs £79.00 a year

to join, and offers one-hour delivery on a large range of items and is priced

similarly in the US.

Amazon

UK Prime customers already benefit from ultra-fast delivery on everything from

essentials like bottled water, coffee but Prime Now will be adding a range of

chilled and frozen items to this selection as they continue to expand the

number and variety of products that can be ordered for delivery within 60

minutes. Simply put service sells, 60 minutes redefines service standards

within the grocery sector.

Currently

Amazon Prime Now UK has a limited assortment of chilled food products (just

under 50 items are available), its one-hour delivery is unique in the market.

Goodfella’s pizzas and Haagen Daaz ice cream are just some of the items that UK

shoppers might want to order quickly.

When

Profitero conducted price analysis of the 49 products available in Prime Now’s

Dairy, Chilled and Frozen category on October 5 2015, matched to UK

supermarkets carrying the identical products in the same pack-size

configuration: Tesco, Sainsbury’s, Asda, Waitrose, Ocado and Morrisons.

Anderston

found that Amazon Prime Now was the clear price leader on these 49 products:

all six supermarkets were shown to be priced higher than Amazon. However, while

all supermarkets’ prices on these items were higher than Amazon Prime Now, we

found that there were varying degrees of price competitiveness between them.

For

example, the average product was found to be 45% more expensive on Ocado than

on Amazon, while Asda and Morrisons prices were 24% and 30% higher

respectively.

Figure

1: Average UK supermarket price vs Amazon Prime Now, October 5 2015 (Source:

Profitero)

And

when Anderson did a deeper dive into the price distribution of UK supermarkets

versus Amazon Prime Now, we found that 75% of Ocado’s products were priced

higher than the same products sold on Amazon (just 20% of products were priced

the same).

By

contrast, Asda priced the same as Amazon across 49% of its products.

Figure

2: Price distribution vs Amazon Prime Now, October 5 2015 (Source: Profitero)

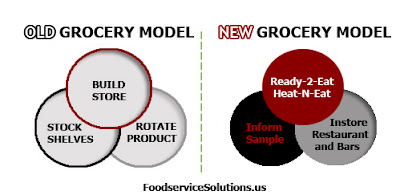

Is

your business model evolving? Are you exceeding your customer expectations? I

hope you have said yes to both, because if you are not others will.

www.FoodserviceSolutions.us specializes in outsourced business development.

We can help you identify, quantify and qualify additional food retail segment

opportunities or a brand leveraging integration strategy. Foodservice

Solutions® of Tacoma WA is the global leader in

the Grocerant niche visit, Linkedin.com/in/grocerant or twitter.com/grocerant Contact Steve@FoodserviceSolutions.us

No comments:

Post a Comment